1.7. VAT (Value-Added-Tax)

Value-Added Tax is commonly known as VAT. VAT is an indirect tax on the consumption of goods and services in the economy. Revenue is raised for government by requiring a business, that carries on an enterprise (as defined in section 1(1) of the VAT Act), to register for VAT. In doing so, the business will charge VAT on supplies of goods and services made by it, on the importation of goods and on imported services (subject to certain conditions). The business will also be entitled to deduct any VAT charged to it, or under limited circumstances from a business that is not registered for VAT, in respect of a supply made to it. VAT is therefore non-cumulative, meaning that a credit/deduction is allowed for VAT paid in previous stages, within the production and distribution chain. The business is required to pay the difference between the VAT charged by it and the VAT charged to it, or claim a VAT refund where the VAT charged to it exceeds the VAT charged by it.

VAT is therefore, charged at each stage of the production and distribution process and it is proportional to the price charged for the goods and services.

The standard rate of VAT increased from 14% to 15% from 1 April 2018. There is a limited range of goods and services which are subject to VAT at the zero rate or are exempt from VAT.

Value Added Tax

VAT is an indirect tax that is largely directed at the domestic consumption of goods and services and at goods imported into South Africa. The tax is designed to be paid mainly by the ultimate consumer or purchaser in South Africa.

Any person that carries on an enterprise, as defined in section 1(1) of the VAT Act, may qualify to register for VAT. A person is a defined term and includes a company, individual, partnership, trust fund, and a municipality.

It is compulsory for a person to register for VAT if the value of taxable supplies made or to be made, is in excess of R1 million in any consecutive twelve month period.

A person may also choose to register voluntarily if the value of taxable supplies made, or to be made, is not in excess of R1 million in any consecutive twelve month period.

The first category applies to a specific type of person where there is no threshold for the value of taxable supplies.

The second category applies to a person that has made R50 000 in the past period of twelve months.

The third category applies to a person where the value of taxable supplies has not exceeded R50 000 and the conditions for registration are listed in a Regulation.

The fourth category applies to a person that has acquired a business as a going concern.

The fifth category applies to a person that carries on a specific nature of activity as listed in a Regulation. In addition, there are other general requirements that must also be met for a voluntarily registration for VAT.

A person who is registered (under compulsory or voluntary registration) or required to be registered (under a compulsory registration) for VAT is referred to as a vendor.

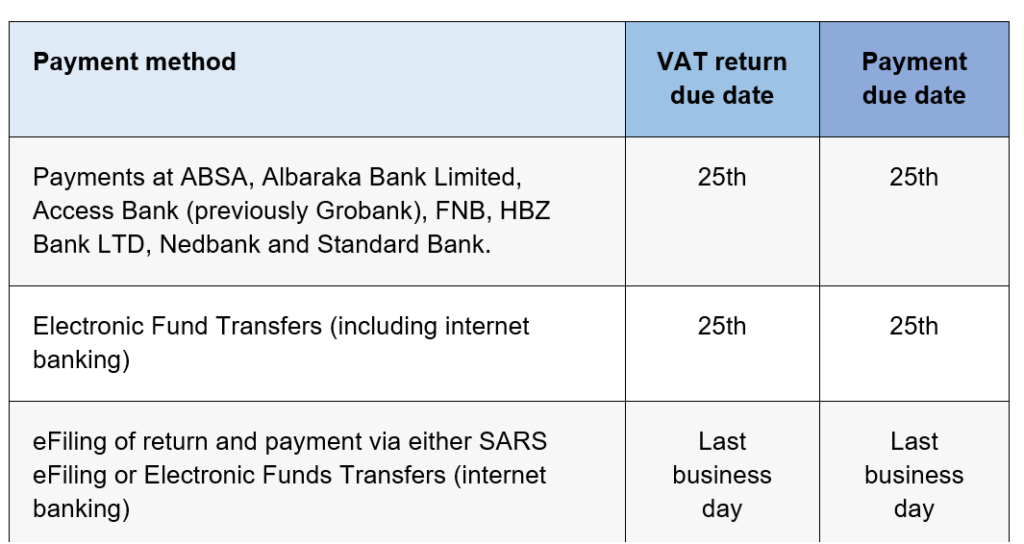

A vendor is required to submit VAT returns and make payments of the VAT liabilities (or claim a VAT refund) on or before the 25th day or the last business day of the month following the month in which the vendor’s tax period ends. If the 25th day is not a business day, the day for submitting a return and making payment will be the business day preceding such day. Late payments of VAT will attract a penalty and interest.

Vat Returns

A VAT Return calculates how much VAT you owe HMRC (or how much they owe you) by looking at: Your total sales and purchases across a three-month accounting period. The amount of VAT you owe for sales. The amount of VAT you can reclaim for purchases made by your business.

The SARS website does not host old or withdrawn documents, except for Legal Counsel publications such as, published Proclamations, Regulations and Government Notices, as well as the archived VATNews.

Tasks

Watch the following video to gain more insight into VAT: