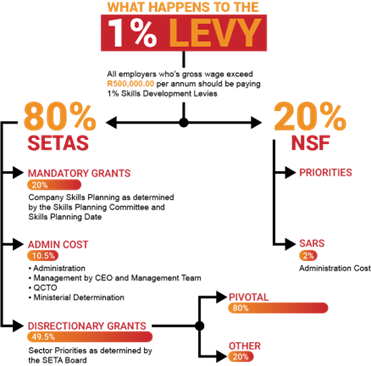

1.10 Skills Development Levy (SDL)

SDL is a levy imposed to encourage learning and development in South Africa and is determined by an employer’s salary bill. The funds are to be used to develop and improve skills of employees.

SDL is due by employers who have been registered.

Skills Development Levy

SDL is a levy imposed to encourage learning and development in South Africa and is determined by an employer's salary bill. The funds are to be used to develop and improve skills of employees.

Tasks

Watch the following video to gain more insight into the skills development levy:

- Any public service employer in the national or provincial sphere of Government. (These employers must budget for an amount equal to the levies due for training and education of their employees).

- Any national or provincial public entity, if 80% or more of its expenditure is paid directly or indirectly from funds voted by Parliament. (These employers must budget for an amount equal to the due for training and education of their employees).

- Any public benefit organisation (PBO), exempt from paying Income Tax in terms of Section 10(1) (cN) of the Income Tax Act No.58 of 1962, which only carries on certain educational, welfare, humanitarian, health care, religion, belief or philosophy public benefit activities or only provides funds to these PBO and to whom a letter of exemption has been issued by the Tax Exemption Unit (TEU).

- Any municipality to which a certificate of exemption is issued by the Minister of Higher Education and Training.

- Any employer whose total remuneration subject to SDL (leviable amount) paid/due to all its employees over the next 12 month period won’t exceed R500 000. If this is the reason for exemption, these types of employers are not required to register to pay SDL.

1% of the total amount paid in salaries to employees (including wages, overtime payments, leave pay, bonuses, fees, commissions and lump sum payments). The amounts deducted or withheld by the employer must be paid to SARS on a monthly basis, by completing the Monthly Employer Declaration (EMP201). The EMP201 is a payment declaration in which the employer declares the total payment together with the allocations for PAYE, SDL, UIF and/or Employment Tax Incentive (ETI).

A unique Payment reference number (PRN) will be pre-populated on the EMP201, and will be used to link the actual payment with the relevant EMP201 payment declaration.

It must be paid within seven days after the end of the month during which the amount was deducted. If the last day for payment falls on a public holiday or weekend, the payment must be made on the last business day before the public holiday or weekend.

The levies are distributed via SETA.